Your cart is currently empty!

Research Reports

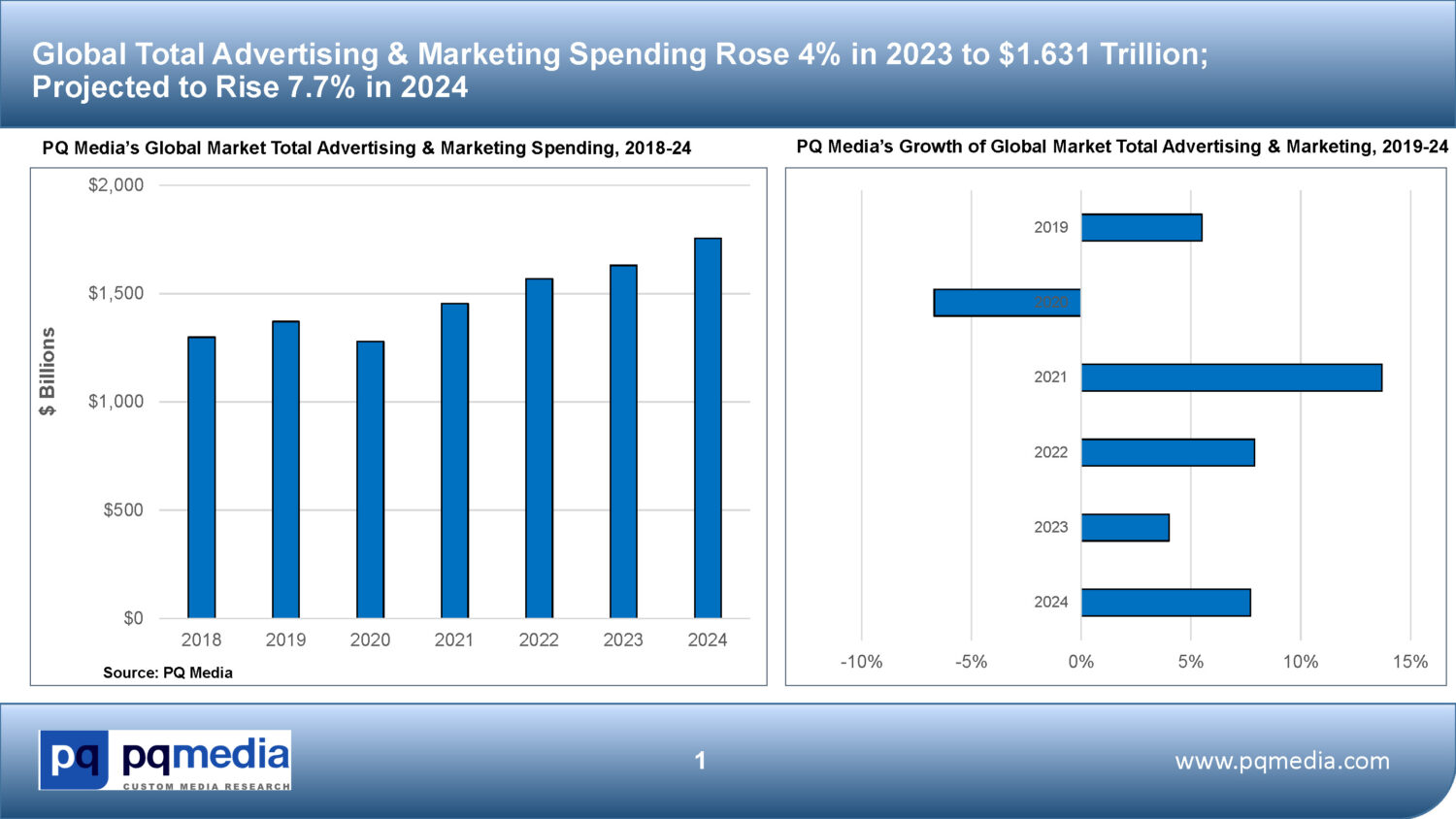

Global Advertising & Marketing Spending Forecast 2024-2028

Description

PQ Media’s Global Advertising & Marketing Spending Forecast 2024-2028 is the 11th edition of the advertising & marketing industry’s recognized annual performance benchmark, delivering actionable market intelligence, econometric data, and expert analysis of traditional, digital & alternative media spending, growth, key trends, emerging opportunities, and projected outcomes by country, media sector, platform and channel for the 2018-2028 period.

PQ Media analysts use our proven econometric methodology to do the hard work you don’t have time to do, as the new edition of the Global Advertising & Marketing Spending Forecast 2024-2028 provides you with exclusive, in-depth datasets, market sizing, PEST trend analysis, and growth projections with the most comprehensive and holistic view of the shifting media landscape available anywhere. In short, we make it easier for you to harness the critical strategic intelligence you need for more effective business planning.

We understand your vital need for a trusted research partner to deliver consistent and reliable media industry definitions, segmentation, market insights, multichannel datasets, and actionable industry forecasts to help you benchmark your performance, improve strategic planning and enhance tactical execution.

Many key stakeholders are no longer questioning whether the advertising & marketing industry has rebounded from the steep drop in spending in 2020 due to the impact of COVID-19 on the global media industry. The question in 2024 is how quickly brands are shifting from traditional media to digital & alternative media.

PQ Media’s research team developed the new Forecast by using our proven econometric methodology, proprietary databases, and exclusive Global Opinion Leader Panel to collect ground-level data, perform thorough analysis of key market variables, and synthesize all our primary research, data and analysis into mission-critical deliverables designed to help you achieve your strategic growth objectives.

The latest edition of the Forecast will help you answer the tough business questions keeping you up at night, as the global media economy emerged from the pandemic-struck 2020 and the 2021-2022 recovery years to rebound sharply in 2023, despite rate hikes, inflationary fears and rumblings of an imminent recession, to exceed pre-pandemic 2019 levels in most markets, media platforms and channels.

The Global Advertising & Marketing Spending Forecast 2024-2028 includes a thorough examination of more than 150 media sectors, silos, platforms, channels and categories across the top 20 global markets and the rest of the countries included in the world’s 4 key regions – the Americas, Europe, Asia-Pacific, and Middle East-Africa.

PQ Media’s unrivaled coverage of the global media economy provides you with media spending and growth estimates for year-end 2023 and our expert insights and forecasts for what’s ahead in the 2024-2028 period, including in-depth coverage of both the advertising and marketing sectors; 15 hybrid traditional & digital media silos; 10 overall digital & alternative media platforms; 45 digital & alternative media channels; and 11 traditional media platforms.

The econometric data and analysis contained in the new Forecast are mission-critical and actionable, which makes this year’s edition vital to your strategic planning, given the unprecedented shakeup of the media economy in 2020. While streaming video and audio services surged during the peak of the pandemic, forcing consumers indoors for longer periods and pushing up digital video and audio consumption, at what point will these channels reach saturation?

Meanwhile, leading advertisers were compelled to quickly change planned media strategies and tactics, as major brands scrambled to target, engage and activate more elusive, fickle and overwhelmed consumers. Astute brand marketers shifted their budgets to media channels capable of breakthrough engagement amid the heavy fog that descended on the industry. As we traverse through 2024, we’re seeing a leveling of some of the pandemic-fueled cyclical trends and the re-emergence of secular trends that have been driving the industry for years.

As a result, our research analysts designed the new Forecast specifically to help you make smarter business decisions with intelligent data, analysis and forward-looking insights, which are contained in the two key deliverables that come with a site license to the Forecast:

- PDF Report & Analysis delivers over 450 PowerPoint slides providing hundreds of data-driven charts, graphs, industry rankings, keen market insights, and detailed profiles of each of the 20 largest global media markets, which account for more than 90% of the world’s ad & marketing spend;

- Deep-Dive Excel Databook provides 100,000+ datasets and datapoints delivering crucial drill-down data by country, media sector, silo, platform and channel, including 10 years of spending, growth and market share data for the 2018-2028 period.

To review the breadth and depth of the new Global Advertising & Marketing Spending Forecast 2024-2028, download a FREE Executive Summary, Sample Datasets, and the Full Table of Contents by filling out the short form that appears above after you click the “Free Sample Download” button. Please ensure your email address is correct because it will be used to send you the links to download the free report samples.

The new Forecast is one of three reports in PQ Media’s annual Global Media Forecast Series, delivering the only holistic view of the worldwide media economy with each report focusing on one of the industry’s three KPIs: Advertising & Marketing Spending; Consumer Media Usage; and Consumer Spending on Media. Click the GMF Series link above to download free report samples from each of the three reports published in 2023, which are being updated for release in the March-May 2024 period.