Your cart is currently empty!

Research Reports

Global Consumer Spending on Media Forecast 2025-2029

Description

PQ Media’s 12th annual Global Consumer Spending on Media Forecast 2025-2029 delivers the most comprehensive and actionable strategic intelligence on consumer spending on digital and traditional media content and technology, including econometric data and analysis of the 2 overall spending sectors (media content and technology); 5 total spending segments (unit purchases, content subscriptions, access, devices, and software); and 28 digital and 14 traditional media content and technology categories.

The new edition of the Forecast is designed to provide media industry stakeholders like you with mission-critical market research, insights and growth projections you need to make smarter business decisions in a fast-changing global media economy.

PQ Media analysts utilize our proven econometric methodology to collect, analyze and synthesize market intelligence to project outcomes across all categories of consumer spending on digital and traditional media content, access, technology, software and services in the top 20 global markets and the rest of the countries across all 4 major regions.

With the growth challenges and opportunities posed by several key macroeconomic variables in 2024 and 2025, such as the ongoing tariff war and potential global inflation, interest rates at highest level in years, and geopolitical tensions, we understand your critical need for a trusted research partner to deliver consistent, reliable and in-depth datasets, market segmenting and sizing, PEST trend analysis and actionable growth projections to help you benchmark your performance, improve strategic planning and enhance tactical execution.

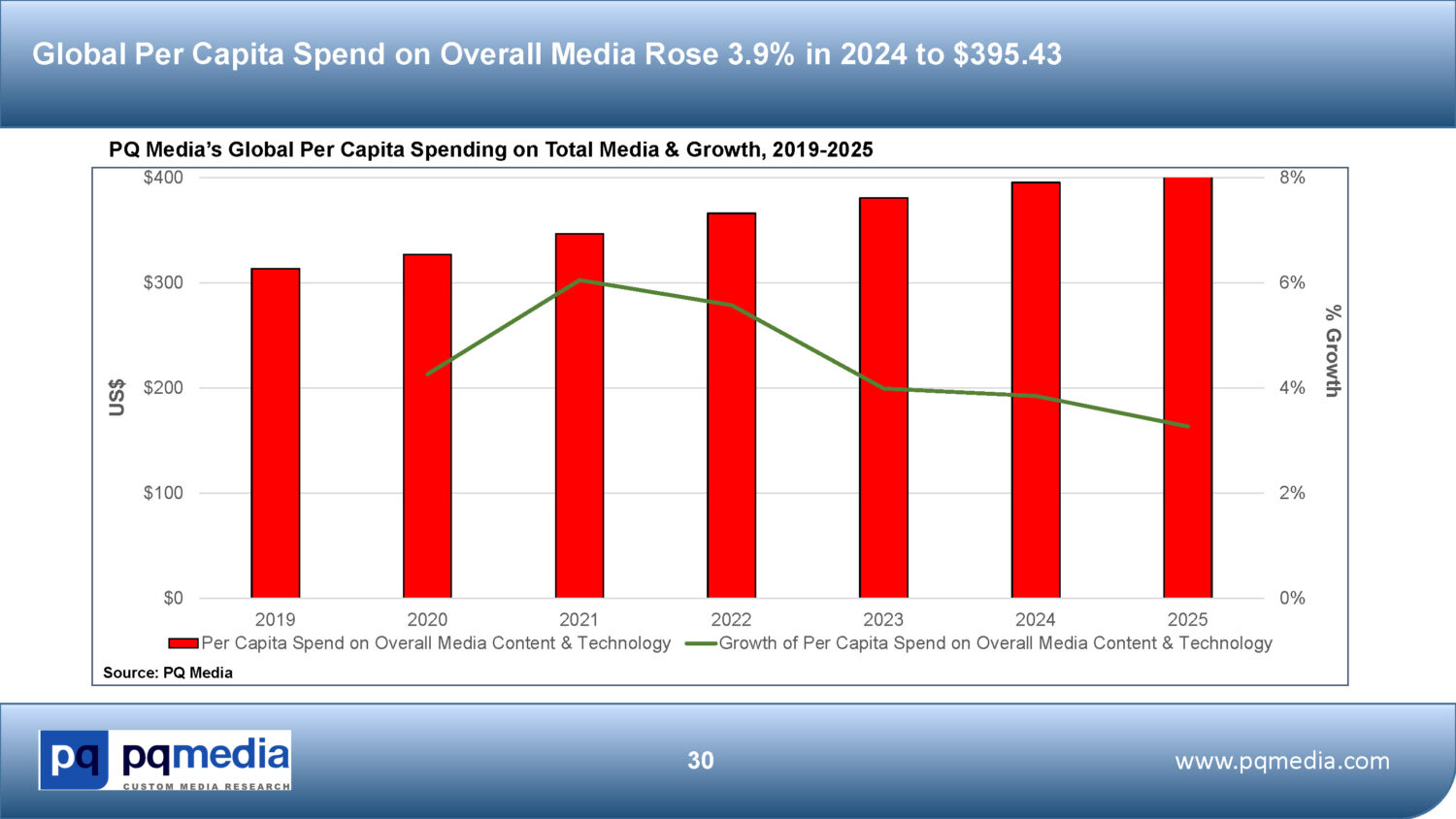

Global consumer spending on overall media content and technology grew at a 4.4% rate in 2024 to $2.371 trillion, the third consecutive year of deceleration following an increase of 4.5% in 2023, after the strongest growth in consumer media spending in a decade in 2021 (6.7%). Consumer spending on media registered its weakest growth rate since 2019 due to many media channels nearly reaching a penetration saturation point, including smartphones and streaming services, which lead to the lowest number of new subscribers ever for digital media channels. Positives in 2024 included recorded music vinyl albums and print books, and price hikes to drive growth for streaming subscriptions.

Consumer spending on media is expected to continue to decelerate during the 2024-2028 forecast period, although spikes will occur during even years fueled by international sporting events that drive spending on television sets, streaming video and video-on-demand. This even-year revenue spike will be more noticeable in the Americas region as the 2026 FIFA World Cup will be tri-hosted by the US, Canada and Mexico, while 2028 Summer Olympics will be in America.

As PQ Media predicted years ago, while the pandemic effect briefly interrupted key secular trends in 2020-2021, this was a near-term disruption of long-term trends that resumed in 2022 and will continue during the 2025-2029 period, such as decelerated growth or outright declines in various digital and traditional media content and technology categories, with some media products slowly becoming obsolete like dial-up internet; feature mobile phones; music CDs and CD players; single music downloads and MP3 players; video DVDs, DVD players, and home video subscriptions.

With these macroeconomic headwinds, PQ Media’s new Global Consumer Spending on Media Forecast 2025-2029 provides you with site license options that include the following key deliverables crafted to deliver actionable market intelligence aimed at helping you manage the secular downtrends produced by a changing media landscape so you can achieve your strategic growth objectives in a post-pandemic era:

- PDF Report & Analysis in PowerPoint slide format delivering over 500 slides of actionable strategic intelligence, with 125 slides of analysis and 350 exclusive datagraphs for more efficient and effective strategic comparisons, internal reporting and client presentations;

- Deep-Dive Excel Databook that provides 150 spreadsheet tabs, detailed datasets by country, media sector, segment and category, delivering nearly 100,000 datasets and data points, giving you the most comprehensive perspective of consumer spending on media content and related hardware and software available anywhere.

The following are just some of the key features and benefits you will receive with a site license to the new edition of our annual consumer media spending report:

- Deep-Dive Profiles of the Top 20 Global Media Markets in All 4 Major Regions;

- Spending & Growth Data for 2019-2024, with 5-Year Forecasts to 2029;

- 2 Overall Consumer Media Spending Sectors:

- Consumer Content

- Consumer Technology

- 5 Consumer Media Spending Segments

- Content Unit Purchases

- Content Subscriptions

- Access

- Devices

- Software & Services

- 28 Digital Media & 14 Traditional Media Spending Categories;

- 11 Hybrid (Digital & Traditional) Consumer Media Spending Silos;

- Global Consumer Media Content & Technology Market Rankings by:

- Total Spending, Growth & Share by Country

- Annual Per Capita Spending & Growth

- Digital vs. Traditional Media & Tech Spending Shares of Markets

To download a FREE Executive Summary and Sample Datasets from the new Global Consumer Spending on Media Forecast 2025-2029, please fill out the short form that appears after you click the “Free Sample Download” button above. Please ensure your email address is correct because it will be used to send you the links necessary to download the free report samples.

Press Release not currently available for this Report.