Your cart is currently empty!

Research Reports

United States Audio Media Forecast 2021

Description

PQ Media’s new United States Audio Media Forecast 2021 is the first, most comprehensive, in-depth and actionable source of econometric data and analysis covering the entire audio media industry for the 2019-2023 period by all three industry KPIs – audio advertising & marketing revenues, consumer audio usage, and consumer spending on audio content and technology – covering 50 audio media platforms, channels and categories.

The new US Audio Media Forecast is further differentiated from other recent industry research in that it includes exclusive data and confidential insights provided by leading audio media companies; radio station and network groups; digital streaming audio services; podcast producers; audio advertising agencies; and media investment firms.

Audio has proven to be a resilient medium since its rise to the fore of the media spectrum in the 1920s, as it has continually adapted to strong challenges posed by the emergence of new technologies, such as television in the 1950s, as well as related changes in consumer behaviors and resulting shifts in ad budgets. All three of these critical PEST trends were strongly impacted by COVID-19, but as these key variables evolved with the severe impact of the pandemic in 2020, audio media once again rose to the challenge and showed its staying power with consumers.

And with the continued growth in the popularity of podcasting in 2021 and the increased use of smart tech to listen to digital extensions of radio stations, traditional OTA broadcasts have remained the most popular audio content consumers listen to in their cars.

Among other key trends revealed in this groundbreaking market research study are the following:

- AM/FM will remain the primary way consumers access audio through 2023, far outweighing consumer time spent with Spotify and Pandora;

- Content is king, as listenership will rise in audio segments that provide new, more engaging content, such as multicultural-focused programming on AM/FM stations, the emergence of new podcasting genres and riveting Q&A interviews on social media audio;

- Podcasting has become the sexiest audio media channel, enticing more brands to audio that, previously, had not included this medium in their omnichannel advertising and marketing campaigns;

- Hispanic audio – both digital and traditional – has emerged as a major force in the overall audio media industry, as Hispanic OTA advertising, streaming audio ad spend, and podcast advertising are all on pace for double-digit growth surges in 2021.

The new US Audio Media Forecast is the only media research to deliver actionable econometric data and primary analysis covering every KPI, platform, channel and category of the growing audio media sector. The following is a detailed list of the new Forecast’s audio media coverage:

♦OVERALL AUDIO MEDIA SPENDING (Advertising, Marketing & Consumer)

*TOTAL AUDIO ADVERTISING & MARKETING SPENDING

- Audio Advertising

- Total Audio Advertising

- Over-the-Air (OTA)

- Radio Stations

- Radio Networks

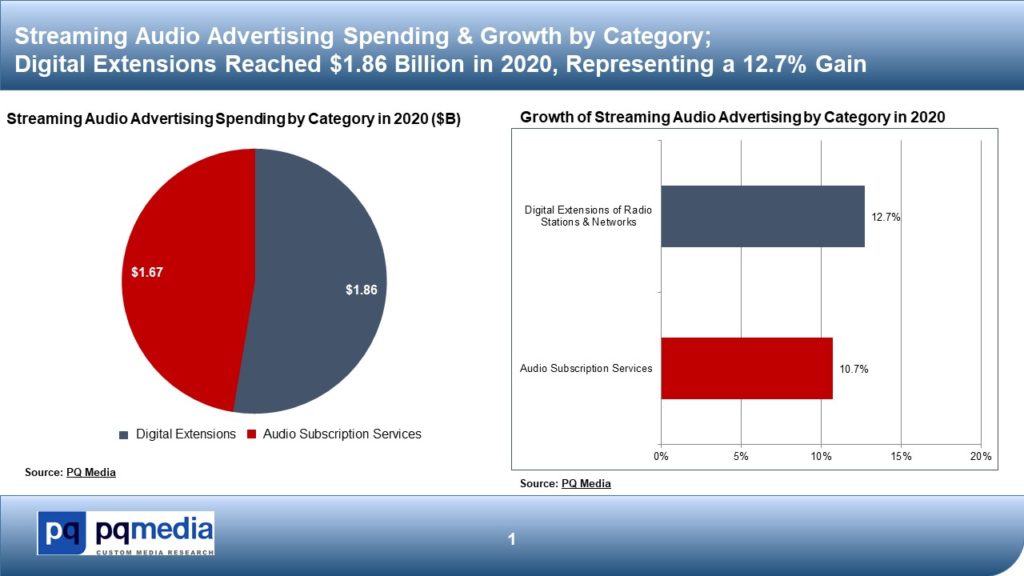

- Streaming Audio

- Digital Extensions to Stations & Networks

- Audio Subscription Services (a)

- Podcasting

- Audio Podcasting

- Satellite

- Satellite Radio

- Audio Marketing

- Total Audio Marketing

- Audio Experiential Marketing

- Audio Promotional Marketing

- Total Audio Marketing

- Hispanic Audio Advertising & Marketing

- Total Hispanic Audio

- Hispanic Audio Advertising

- Hispanic Audio Marketing

- Total Hispanic Audio

*CONSUMER AUDIO USAGE (Hours Per Week)

- Total Audio Usage by Distribution Method

- Over-the-Air

- Digital Extensions, Streaming Services & Podcasting

- Satellite

- Total Audio Usage by Modulation

- FM (OTA + Digital Extensions + Streaming Services)

- AM (OTA + Digital Extensions + Streaming Services)

- Podcasts

- Satellite (+ Digital Extensions + Streaming Services)

- Total Audio Usage by Location

- Home

- Out-of-Home

- Car

- Other (Work, Public Places, etc.)

- Total Audio Usage including Recorded Music

- Over-the-Air

- Streaming Audio

- Podcasts

- Satellite Radio

- CDs, Vinyl Albums, Cassettes & Music Videos

*CONSUMER SPENDING ON AUDIO CONTENT & TECHNOLOGY

- Overall Audio Content & Technology Spending

- Total Audio Content

- Digital Audio Content

- Audio Subscription Services

- SoundExchange Royalties

- Radio-Only Digital Subscription Services

- Audio Podcast Subscriptions

- Satellite Content

- Satellite Subscriptions

- Audio Technology

- Home Components & OEM Car Receivers

- Digital Audio Receivers (DAR) & Smart Speakers

Given the impact of COVID-19 on the global media industry, we understand your critical need for a trusted research partner to deliver consistent, reliable and accurate industry segmentation, market insights, multichannel datasets, and actionable growth forecasts to help you benchmark your performance, improve strategic planning and enhance tactical execution.

In short, PQ Media’s analysts have done the drill-down work you don’t have time for so we can deliver to you exclusive, in-depth datasets, market sizing, PEST trend analysis and growth projections, all crafted into the only holistic view of the growing audio media landscape.

Using our proven econometric methodology, proprietary databases and exclusive Global Opinion Leader Panel, we synthesized all our market intelligence into the two mission-critical deliverables you will receive with a site license to the new Forecast:

- PDF Report & Analysis in PowerPoint format delivers 553 slides of original data, analysis and datagraphs for easy strategic comparisons, internal reporting and client presentations;

- Deep-Dive Excel Databook delivering hundreds of drill-down datasets and actionable datapoints providing the most comprehensive coverage of the US audio media sector available anywhere

Among the valuable features you will benefit from with a site license to the new Forecast, which are aimed at helping you achieve your strategic growth objectives and improve your business outlook, are the following:

- Benchmark the performance of the entire US audio media market with exclusive data and insights on digital and traditional audio ad revenues; 5 years of annual market size and growth data; the only consistent and comprehensive tracking data on consumer time spent with digital and traditional audio media;

- Analyze exclusive and consistent historical, current and forecast datasets for the 2019-2023 period, including current 2021 pacing estimates;

- Clear and concise audio media definitions, segmentation, market sizing, and growth projections supplemented by analysis of key growth drivers and emerging market challenges;

To download a FREE Executive Summary, Table of Contents, and Sample Datasets from the new United States Audio Media Forecast 2021 just fill out the short form after you click on the “Free Sample Download” button above. Please make sure your email address is correct because we will use it to send you the links necessary to download the free samples.