Your cart is currently empty!

Research Reports

United States LGBTQ+ Media Forecast 2026-2030

Description

PQ Media has launched the first-ever United States LGBTQ+ Media Forecast 2026-2030, the only credible source for comprehensively research, data, analysis and actionable intelligence on the complex LGBTQ+ media market. This groundbreaking new publication includes detailed definitions, market segmentation, spending data, growth drivers, and five-year growth projections across the entire LGBTQ+ media market.

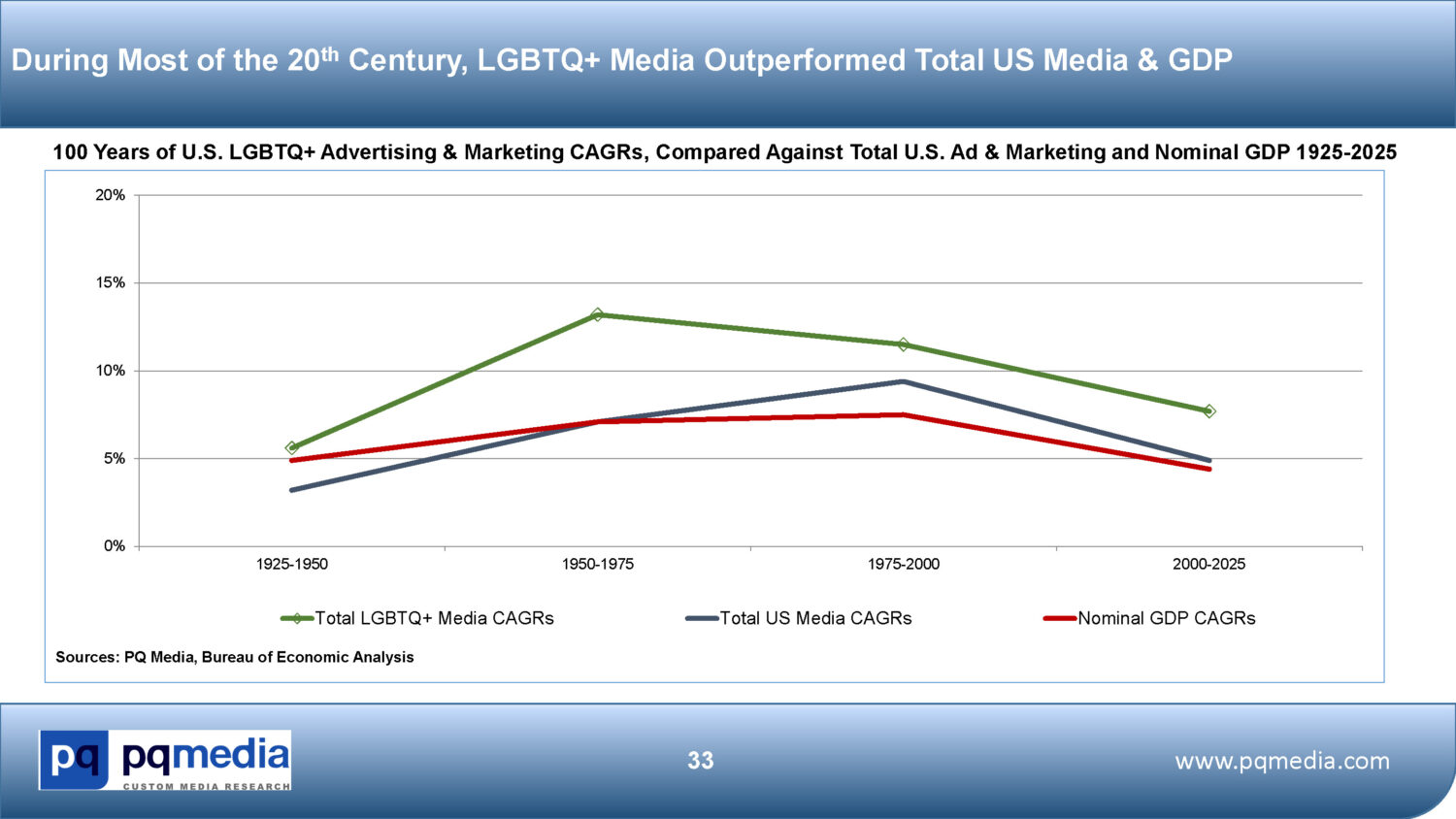

The Forecast also provides in-depth coverage of 14 LGBTQ+ media platforms, including 8 advertising and 6 marketing platforms, as well as 42 media channels, and 2 major media buying categories: endemic vs. non-endemic, and local vs. national. The new Forecast marks the first and only in-depth examination of the domestic LGBTQ+ media market ever done, highlighting the largest and fastest-growing media platforms and channels, while delivering exclusive strategic intelligence covering the entire 2020-2030 period. Also included in the report is a 100-history of the 14 LGBTQ+ media platforms from 1925-2025, in 10-25 year increments.

LGBTQ+ ad and marketing spend is expected to rise only 2.2% in 2025 to $11.7 billion, decelerating from the 5.6% gain registered in 2024 when political campaigns targeted LGBTQ+ voters in swing states. LGBTQ+ media accounted for only 1.6% of the $746.6 billion of total ad and marketing spend in 2025, down from the 1.8% share in 2020, according to PQ Media’s United States LGBTQ+ Media Forecast 2026-2030.

For much of the 21st century LGBTQ+ media had been outpacing overall ad & marketing growth, including during the two recessions in 2008-09 and 2020. However, brands began to pull back support for LGBTQ+ events in 2023 following the controversial boycott of Bud Light after it used a transgender actor in its Super Bowl ad. Organizations that run PRIDE festivals reported significant declines in corporate sponsorships in 2023 and 2024, which weakened in 2025 due to political pressure on companies to disband their DEI programs.

Key LGBTQ+ stakeholders shared their views with PQ Media’s Global Opinion Leader Panel regarding the future of this market, and their outlook is not optimistic in the short-term. While we expected a slight acceleration in growth in 2026 due to the influx of political media buying, our Opinion Leader Panel is predicting an almost flat market until 2028. And this is despite the fact that the LGBTQ+ market over-indexes in purchasing cars, electronics, fashion, financial services and travel, among others. In addition, the LGBTQ+ community has favorable demographics that brands often target, such as skewing younger than the general population, more likely to be female, and be located in major metros like New York, Los Angeles and San Francisco.

So, with the growth challenges posed by these key variables in 2025 and beyond, as well as the tariff wars, inflation, interest rates hikes, and geopolitical tensions, we understand your critical need for a trusted research partner to deliver consistent, reliable and in-depth data, insights, and PEST trend analysis to help you benchmark performance, improve strategic planning and enhance tactical execution to take advantage of the growth opportunities that exist in this expanding market.

PQ Media’s new United States LGBTQ+ Media Forecast 2026-2030 provides you with the following site license options that include the following key deliverables crafted to deliver actionable market intelligence aimed at helping you achieve your strategic growth objectives amid the ever-changing media landscape:

- PDF Report & Analysis in PowerPoint slide format delivering 238 slides of actionable strategic intelligence, with 65 slides of analysis and 226 exclusive datagraphs for more efficient and effective strategic comparisons, internal reporting and client presentations;

- Deep-Dive Excel Databookthat provides 10 spreadsheet tabs, detailed datasets by 100-year history and past 10 years, by media sector, segment and category, delivering 8,884 datasets and data points, giving you the most comprehensive perspective of consumer spending on media content and related hardware and software available anywhere.

The following are just some of the key features and benefits you will receive with a site license to the first-ever LGBTQ+ Media Forecast 2026-2030:

- 100 Years of LGBTQ+ Media Spend & CAGR Growth Data from 1925-2025

- 1925, 1950, 1975, 1990, 2000, 2010, 2020, 2025

- Eight LGBTQ+ Advertising Platforms

- Six LGBTQ+ Marketing Platforms

- LGBTQ+ Media Share of Overall U.S. Advertising & Marketing Spend

- Spending & Growth Data for 2020-2025, with 5-Year Forecasts to 2030

- Eight LGBTQ+ Advertising Platforms with 21 Channels

- Six LGBTQ+ Marketing Platforms with 21 Channels

- Breakouts by Endemic vs. Non-Endemic Spending & Local vs. National Spending

- LGBTQ+ Media Share of Overall U.S. Advertising & Marketing Spend

- Over 60 definitions of the media sectors, platforms & channels covered, as well as over 30 LGBTQ+ demographic profiles

- List of Over 8,000 LGBTQ+ Media Companies, Content & Brand Sponsors

- List of Over 2,000 Sources Used to Compile the LGBTQ+ Media Forecast

]To download a FREE Executive Summary and Sample Datasets from just-released United States LGBTQ+ Media Forecast 2026-2030, please fill out the short form that appears after you click the “Free Sample Download” button above. Please ensure your email address is correct because it will be used to send you the links necessary to download the FREE report samples.