Your cart is currently empty!

INTRODUCTION

Dear PQ Media Friends,

Welcome to your FREE issue of the new PQ Media Intellicast newsletter! PQ Media has launched this newsletter to focus on fulfilling a number of outstanding market intelligence needs expressed to us through a survey performed earlier this year of our current, past and new clients who have purchased either our annual market intelligence publications or our custom drill-down research services.

As a member of one of these client verticals, you have been selected to receive each of the first four issues of this newsletter on a monthly basis in October, November, December and through the final FREE issue to be distributed in January 2022.

Our objectives in providing these four monthly issues to you at no cost are to share more of our data and content with you to help educate you on the diverse set of media industry sectors, segments, platforms and channels we cover, which we hope will inform some of your decision-making and give you a better understanding of the breadth and depth of our media and technology industry research coverage.

We encourage you and your colleagues to sign up for this Free Trial via the sign-up form that appears on our website after you click the following link: PQ Media Newsletter Signup. We also encourage you to share your critical feedback – in strict confidence – about the content and usefulness of this new research-driven newsletter by emailing us at info@pqmedia.com.

Following publication of the fourth issue in January 2022, we will be relaunching this newsletter through a cost-effective subscription format, which will be driven by your critical feedback on the value of the data and analysis we’re providing through this free trial period.

Each of the four editions you will receive through January will focus on one of several of the most dynamic and fast-growing segments of the media industry over the past decade, including Branded Enteratinment, Digital Out-of-Home Media, Audio Media, and PQ Media’s holistic perspective on the Global Advertising & Marketing Industry.

I hope your free trial to the new research-driven PQ Media Intellicast will help you grow your business in the coming months, and I look forward to receiving your valuable feedback.

Best regards,

Patrick Quinn

CEO & Publisher

PQ Media LLC

PQ Media Intellicast

PQ MEDIA INTELLICAST (Issue #1, October 2021)

Branded Entertainment – Part 1: Definitions, Segmentation & Growth Drivers

In this first edition, we will examine one of the most consistently fast-growing and constantly evolving alternative marketing segments of the media industry over the past two decades – Branded Entertainment Marketing – which PQ Media was the first market researcher to ever define, segment, size, analyze and forecast the growth of back in 2005. We define branded entertainment by two major platforms – product placement and consumer experiential marketing – and the multiple channels that are included within each of these platforms.

Product Placement (also known as brand integration) is defined as brand marketer (or advertiser) spending on fees to agencies, content producers or media operators in which their objective is to place or integrate brand names, logos or specific products within programmed or filmed content of traditional and digital media, such as television, movies and videogames. Their ultimate goal is to prominently place or creatively integrate brands and products into content to promote brand awareness, favorable brand attitudes and purchase intention. PQ Media’s research covers product placement in television (broadcast, cable and streaming video); theatrical films; digital media (online, mobile and social media); traditional videogames and digital gaming; print media (books, newspapers and magazines); and recorded music (radio and other audio media).

After 10 consecutive years of double-digit growth worldwide, product placement spend declined in 2020 for only the second time in 45 years, going all the way back to the first year of the summer blockbuster in 1975. There are cogent reasons why brand integration has generated such a stellar track record over that long period, as PQ Media’s research indicates that successful product placements lead to online engagement and have the ability to create emotional connections with target audiences, particularly younger demos, such as Millennials and i-Gens, which tend to be more elusive, diverse and tech-savvy.

As a result, paid placements have grown substantially in number and value during the past several decades because brands have become more willing to invest in skillful integration of their logos and products in storylines that will expose their assets in meaningful ways.

Consumer Experiential Marketing includes brand spending on consumer event marketing and consumer event sponsorships that provide marketers with excellent opportunities to engage target consumers in building their brand image, awareness, live connections and often to sell new media products and services, such as streaming audio downloads and subscriptions to new services. We break down experiential marketing by two major channels – live consumer events and consumer event sponsorships, which are further segmented to include multiple channel categories, including sports & entertainment; arts & festivals; causes & associations; mobile roadshows & virtual events; grassroots events; and colleges, malls & nightlife.

Experiential marketing has steadily become more important to brands over the past decade because live experiences, such as music festivals and sporting events, provide excellent opportunities to engage younger consumers. In more recent years, event marketers have also developed improved metrics to gauge various aspects of live experiences. In the years ahead, we expect to see brands move beyond one-time brand activations and evolve their relationships with key demos by utilizing smart tech marketing, tracking and analytics to develop more branded experiences that span the physical, digital and virtual realms.

Branded Entertainment – Part 2: Product Placement

Global Market Analysis

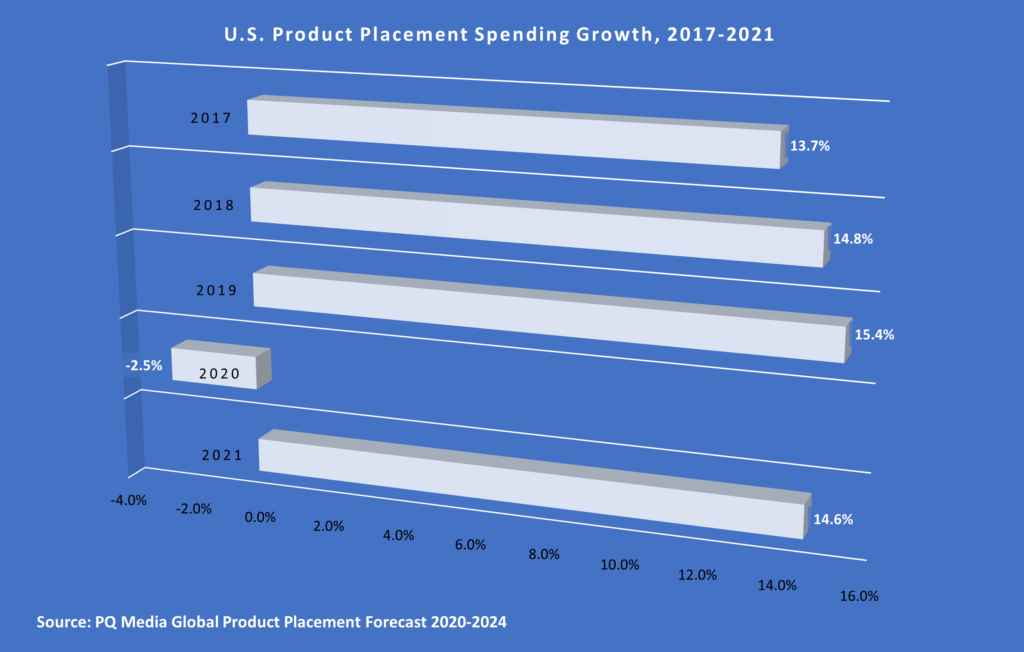

While the retrenchment of the US product placement market in 2020 was the steepest decline recorded in the 45 years PQ Media has been tracking product placement, it marked only the second time brand integration spending declined since 1975. There are compelling reasons why this so-called “below-the-line” marketing tactic has posted such an enviable track record over nearly five decades.

PQ Media’s research indicates that deft product placement leads to online engagement and has the ability to create emotional connections with key demographics, such as Millennials, i-Gens and m-Gens, which are more mobile, diverse and often averse to traditional media. As a result, paid placements have grown substantially in number and value during the past several decades because brands have become more willing to invest in skillful integration of their logos and products in storylines that will expose their assets in meaningful ways.

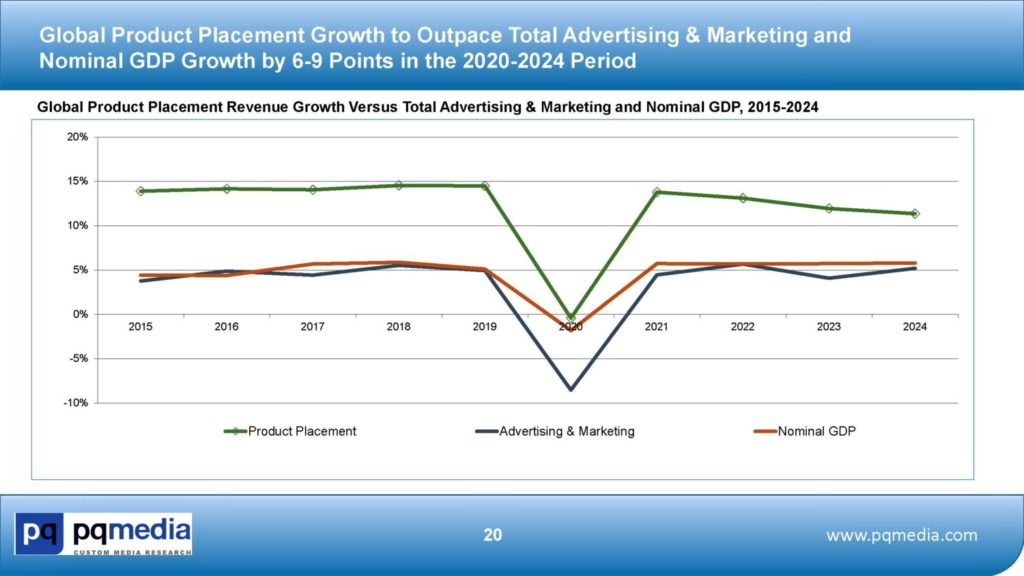

It was this key trend that provided the wind behind product placement’s 10-year double-digit growth and expansion into multiple media platforms worldwide from 2010 through 2019, a year in which product placement spending grew at an accelerated 14.5% to $20.57 billion globally. However, the COVID-19 pandemic that shocked economies and industries across the globe in early 2020 rippled through the product placement industry as well, breaking a growth streak that stretched back to the Great Recession in 2009, according to PQ Media’s Global Product Placement Forecast 2020-2024.

The coronavirus lockdowns delayed releases of new movies and TV series scheduled for launch during the first half of 2020, squelching good opportunities for new brand integration deals to the only TV programs with ongoing production, such as daytime and evening talk shows and a few select reality programs that were already filmed or were doing so under lockdown conditions. Stay-at-home orders forced consumers into homebound cocoons, causing a surge in time spent with streaming video, audio and videogames.

But, as a result, new opportunities emerged on the digital media front, which also caused additional challenges for many traditional media, particularly theatrical films and live events, as movie studios and event producers began scrambling for new means of reaching key audiences and opening up new sources of revenue to offset losses occurring in the global lockdown. Simultaneously, brand marketers began hustling to find ways to garner more visibility among youth audiences, which typically have been more mobile and harder to engage, in the stay-at-home environment.

The combination of tight media budgets, fewer ad avails in traditional media, and limited releases of new content direct to streaming video has opened up strong potential for sponsors and producers to strike mutually beneficial collaborations across multiple media channels and brand categories going forward.

Accordingly, global product placement investments are expected to resume double-digit growth in 2021 and post accelerated growth in 2022 on stronger economic growth, secular media trends favoring branded entertainment in general, and major brands increasing their use of product placement in media content aimed at pre-Boomer audiences.

Global product placement spending is projected to rise 13.8% to $23.31 billion in 2021, fueled by the lifting of pandemic restrictions, stronger economic growth, and the growing value of brand integrations targeting more elusive, tech-savvy and diverse young consumers through various online and mobile media platforms.

The United States will be the chief catalyst of the global rebound in the 2021, as the value of brand integrations in the US is projected to surge 14.8%, fueled by the increased demand for product placements targeting pre-Boomer audiences via streaming video, online gaming, digital audio, virtual events and social media. In the second half of 2022, PQ Media projects that growth will be accentuated by upside from more traditional media segments, such as theatrical films, live events and recorded music, as the injection of a full slate of summer blockbuster movies and live concert series drive accelerated growth in 2H22.

Global Market Deep Dive

While it’s the newest conduit for product placement, streaming video emerged from the damage at the apex of the pandemic in mid-2020 as a key product placement category. In fact, it became the fastest-growing media category, outpacing other digital media, driven by the major shifts in audience viewing habits that occurred during COVID-19 in 2020 and well into 2021, as streaming TV services are now well positioned to expand their share of the overall brand integration business.

While the overall product placement market actually shrunk for the first time in 11 years in 2020 due to the pandemic, streaming services have a lot going for them given two big factors: 1) They don’t generally accept traditional advertising; and 2) the share of consumer viewing going to them is growing fast. In fact, some of the choicest long-term opportunities are in the proliferation of SVOD services worldwide just as the coronavirus outbreak forced consumers indoors for longer periods in 2020, driving up viewing of OTT video programming. While leading subscription video streamers Netflix, Amazon Prime Video, Disney+ and Apple TV+ don’t sell traditional ad spots on their respective services, the incidence of product placement and brand integration in their content offerings, as well as outright branded entertainment programming, has soared in recent years.

Among the high-profile examples in 2020 were Amazon’s Making The Cut, a fashion designer competition in which the winning outfits and, ultimately, the chosen clothing line are sold via Amazon.com. The show has received positive reviews for its use of creative storytelling to engage viewers in the contestants’ lives, forming emotional investments in the narrative and designers, while attaching stronger meaning to the items for purchase. A popular 10-part series released by Netflix in April – The Last Dance, covering Michael Jordan’s rise with the Chicago Bulls – also received critical acclaim for its captivating story and organic integration of Nike sneakers. Another Amazon original released in May 2020, Upload, has been noted for its gaggle of product placements throughout its storylines, including Coca-Cola, Dunkin’ Donuts and X-box.

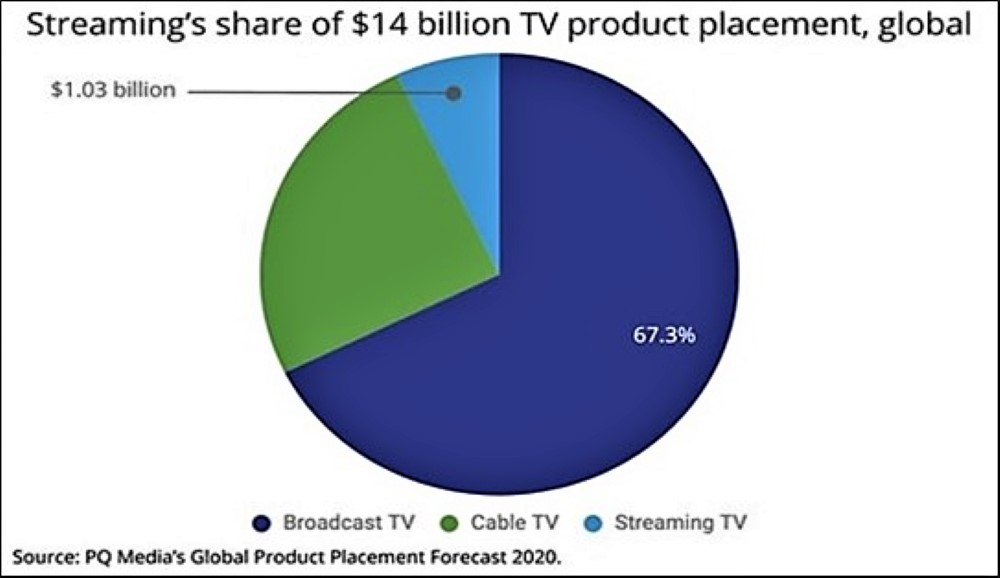

Worldwide, streaming represents a little more than $1 billion in product placement investments, roughly 7% of the total TV product placement marketplace. In the US, streaming accounted for about $710 million in brand integration fees, or about 8% of the U.S. TV product placement marketplace.

While the expanding universe of streaming video services provides significant potential for brands and studios going forward, these deals also tend to be the most challenging to accomplish. But the strong desire to gain brand awareness among target consumers, create positive brand associations and generate sales lift will continue to favor product placement in the post-pandemic era.

Despite the short-term challenges, plot integrations are becoming more commonplace and the number of original broadcast, cable and streaming TV programs has expanded greatly, reaching over 500 in the US alone in 2019, nearly double the number of 2010 programs. Product placement in TV is, by far, the largest spending category, valued at $14.05 billion worldwide, according to PQ Media. Virtual brand integration continues to be tested, refined and used in various digital and traditional video programming, as evidenced by Univision partnering with Mirriad to dynamically insert virtual placements in its popular telenovelas, which account for a significant share of Hispanic TV broadcasters’ annual revenue in the US and Mexico.

Product placement in films, the second largest category, generated $3.04 billion worldwide, as Audi’s first electric car, e-Tron, made a splash in Avenger’s Endgame and French jeweler, Chopard, created buzz with its appearance in the latest installment of the James Bond franchise, No Time to Die. Brand integrations in digital media platforms, including online, mobile and social media channels, grew the fastest, up 20.9% in 2019, as brands continue to align with viral stars on YouTube’s multi-channel networks, using product placements to engage younger audiences.

Full Market Outlook & Free Downloads

PQ Media’s Global Product Placement Forecast 2020-2024 is the 8th edition in the groundbreaking Branded Entertainment Series recognized worldwide as the industry’s biennial performance benchmark. The Product Placement Forecast is the only source to consistently define, segment, size, analyze and project the growth of brand integration in 15 media platforms and channels with detailed profiles of the world’s top 20 markets. The Core Report & Analysis delivers 355 slides of exclusive market data and insights, enhanced by a Deep-Dive Excel Databook providing 250,000 datasets and datapoints by country, media platform and channel. Click the following link to download your FREE executive summary and sample datasets: Global Product Placement Forecast 2020-2024

Branded Entertainment – Part 3: Experiential Marketing

Global Market Analysis

Despite the global pandemic upending the consumer event markets in 2020, secular trends driving brand marketer spending and consumer media usage favor experiential marketing in the years ahead, as branded entertainment and content marketing have become more important components of cross-channel marketing campaigns. Accordingly, consumer experiential marketing is pacing for a rebound in 2021 with 6.1% growth expected worldwide, according to PQ Media’s Global Experiential Marketing Forecast 2020-2024.

In 2020, however, the damage wrought by the novel coronavirus in such a short period was unparalleled in the history of advertising and marketing. Among the hardest hit consumer event markets was the biggest – the United States, which accounts for nearly half of global experiential marketing spending. And no experiential channel or category was spared the deep impact of COVID-19 and its aftershocks, which resulted in an aggregate 15.2% retraction of the US market las year.

Both major experiential channels, including consumer event marketing and event sponsorships, and all breakout categories therein – sports & entertainment; arts & festivals; causes & associations; and mobile road shows & virtual events – suffered under the weight of emergency restrictions last year, such as home quarantines and social distancing, adopted worldwide due to the rapid spread of the novel coronavirus. As a result, nearly half of the 700+ consumer events tracked across the globe were either canceled, postponed or rescheduled for 2021, including many large sponsored events like global concert tours, and sports spectacles such as the Summer Olympics in Tokyo.

Dozens of local and regional fairs, festivals and other grassroots events endured the same fate, such as the Beale Street Music Festival in Memphis, which was cancelled for the first time in its 43-year history. Iconic annual music, entertainment, and sporting events (and entire league schedules) were also canceled, postponed or rescheduled for 2021, including SXSW in Austin, the Cannes Film Festival in France and the NCAA March Madness basketball tournament. Even political experiential marketing felt the brunt of the pandemic, as local elections, campaign rallies and fundraising events were postponed or, in some cases, moved online with marginal success.

Particularly hard hit by the pandemic and the related lockdowns were five of the world’s largest media markets – the US, Brazil, Russia, India, and the UK, together accounting for two-thirds of all reported cases by mid-2020. With states and municipalities either limiting public gatherings or issuing stay-at-home orders, many venues for live events – from outdoor stadiums and concert venues to indoor arenas and auditoriums – were closed, vacant or sparsely populated for any of the few events allowed to be held.

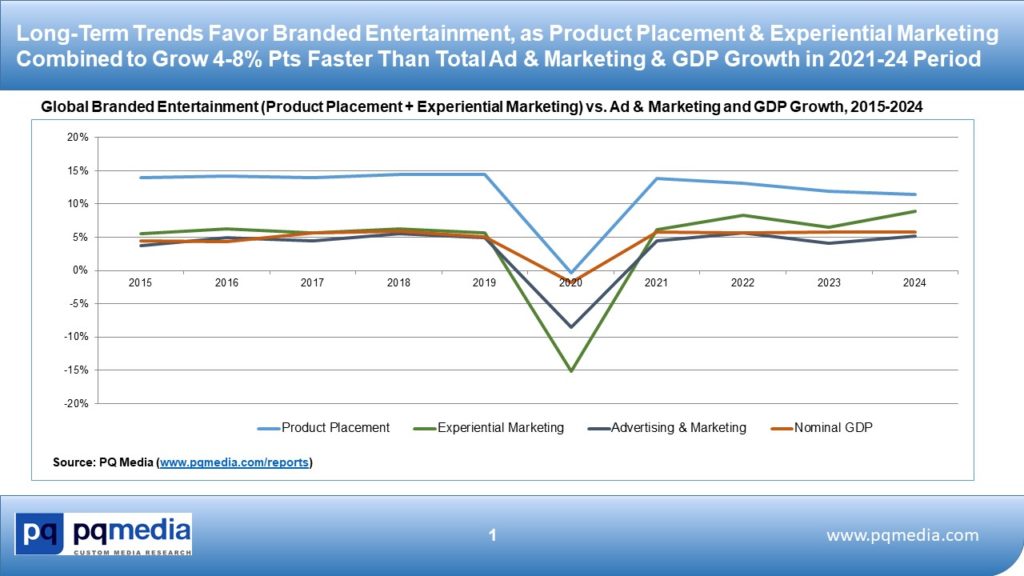

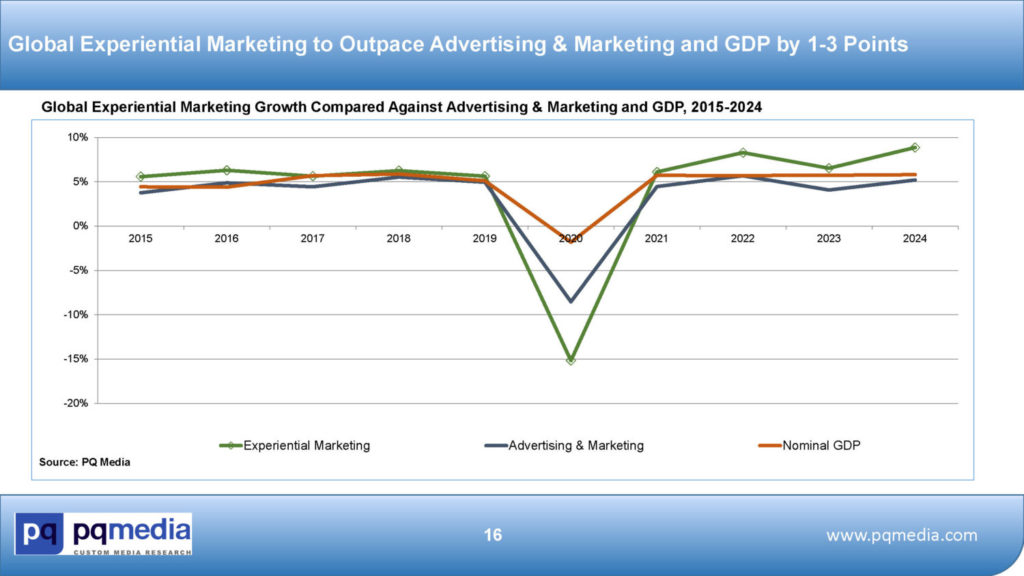

The flash flood caused by the global pandemic in the first half of 2020 squelched a decade-long growth streak in consumer experiential marketing, one of the media industry’s most consistent growth sectors, which also happened to be uniquely vulnerable to all the key countermeasures employed by governments to slow the spread of the coronavirus. Nevertheless, global experiential marketing growth outpaced that of the overall advertising and marketing industry and nominal GDP in the 2015-2020 period by 1-3 percentage points.

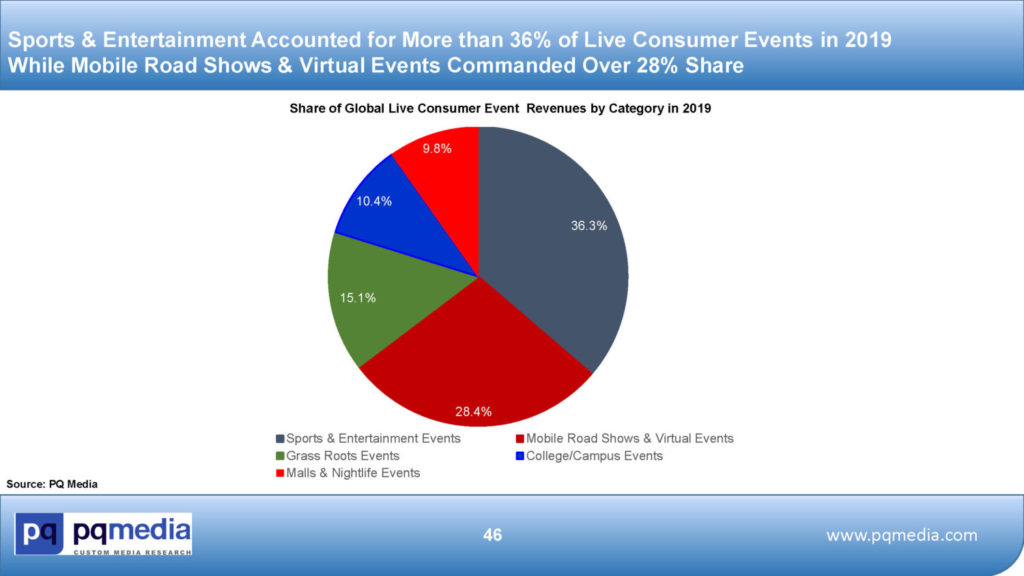

Experiential marketing revenues increased 5.6% in 2019 to $84.07 billion worldwide, with consumer event sponsorships being the larger of the two major channels at $44.66 billion, though live consumer events grew faster, up 7.1%. US experiential marketing revenues grew 6.8% to $40.37 billion in 2019, according to PQ Media estimates.

Global Market Deep Dive

Experiential marketing has steadily become more important to brands over the past decade because live experiences, such as music festivals and sporting events, provide excellent opportunities to engage younger, more mobile and tech-savvy demographics, such as Millennials and iGens. In more recent years, event marketers have also developed improved metrics to gauge various aspects of live experiences. In the years ahead, we expect to see brands move beyond one-time brand activations to evolve their relationships with target audiences and diehard fans by using advanced smart technology marketing, tracking, and analysis tools to create more branded experiences that bridge the physical, digital and virtual spheres.

There were several glimpses of these innovative tactics in 2020 and 2021, including music events that went virtual through online videogames like Fortnite and NASCAR races that took place in e-sports leagues. Another emerging trend is that of popular recording artists using digital videogame platforms to host virtual concerts and launch new content, such as Travis Scott’s performance on Fortnite and Lil Nas X’s concert on Roblox, which received over 33 million views and activated millions of related music downloads of the rest of his catalog. Arianna Grande jumped into the virtual concert theater in August 2021 with her first appearance on Fortnite.

Live Sports & Entertainment events accounted for 34% of US Consumer Event Marketing spend in 2019, while Mobile Road Shows & Virtual Events snared 30% of the total domestic market. The strong desire to gain brand awareness among target audiences, create positive brand associations and, ultimately, produce sales lift will continue to favor consumer experiential marketing in the post-pandemic era.

Full Market Outlook & Free Downloads

PQ Media’s Global Experiential Marketing Forecast 2020-2024 is the 8th edition in our biennial Global Branded Entertainment Series, and site licenses include two deliverables: 1) Core PDF Report, delivering 281 slides of comprehensive data, analysis, charts and graphs covering each country, platform, channel and category, and in-depth profiles of the top 20 global markets; and 2) Deep-Dive Excel Databook, providing 100+ spreadsheet tabs with 100,000+ datasets and datapoints drilling down into each country, platform, channel and category for the 2014-2024 period. You can download a FREE executive summary and sample datasets from the report by clicking here: PQ Media’s Global Experiential Marketing Forecast 2020-2024.

Branded Entertainment – Part 4: Key Takeaways

While the pandemic scuttled 10-year growth surges in both branded entertainment segments in 2020 – product placement and experiential marketing – PQ Media’s research indicates that secular trends in consumer media behaviors and advertiser spending favor both segments going forward because of

their ability to create emotional connections and positive brand associations with younger, more elusive and fickle target consumers, especially Millennials and iGens.

Brands utilizing digital branded media are capitalizing on the increased time these key demographics are spending on mobile, social, online, and streaming media by using influencers, videos, podcasts and interactive game experiences. Among those opportunities are the proliferation of new streaming video and audio services worldwide concurrent to the pandemic forcing consumers indoors for longer periods, driving up viewing and listening times for digital video and audio programming. While leading subscription video streamers Netflix, Amazon Prime Video and Apple TV+ don’t sell traditional ad spots, the incidence of product placement and brand integration in original programs on these services soared in 2020.

Meanwhile, event marketers have been working on better metrics to gauge the performance of live experiences and we anticipate that brands will move beyond one-time brand activations to strengthen and lengthen their relationships with target audiences and diehard fans by using smart tech marketing, advanced tracking and more complex analysis tools to create branded experiences that more often bridge the physical, digital and virtual spheres.

Ultimately, branded entertainment’s ability to satisfy brand marketers’ string desire to gain brand awareness among target audiences, create positive brand associations and produce sales lift will continue to favor product placement and consumer experiential marketing in the post-pandemic era. As a result, PQ Media expects aggregate branded entertainment spending to grow 4% to 8% points faster than overall advertising and marketing spending as well as nominal GDP in the 2021-2024 period.