Your cart is currently empty!

Archives: Newsletter

PQ MEDIA INTELLICAST (Issue #4, January 2022)

—

by

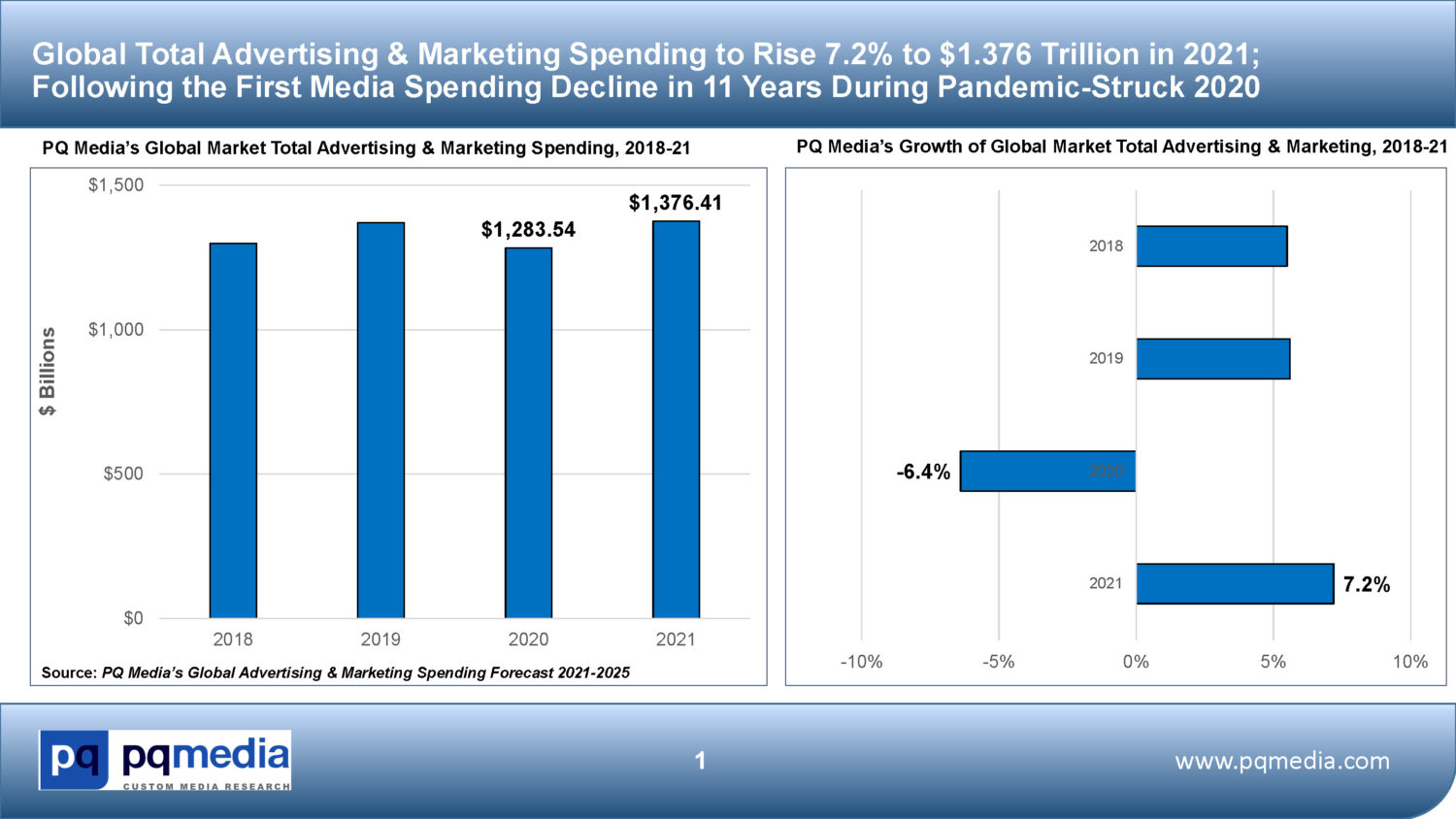

Global Advertising & Marketing Media – Part 1: Definitions & Segmentation The 4th edition of this newsletter focuses on Global Advertising & Marketing Media, supported by exclusive data gleaned from the recently released 9th annual edition of PQ Media’s Global Advertising & Marketing Spending Forecast 2021-2025. The Forecast is the advertising & marketing industry’s most comprehensive…

PQ MEDIA INTELLICAST (Issue #3, December 2021)

—

by

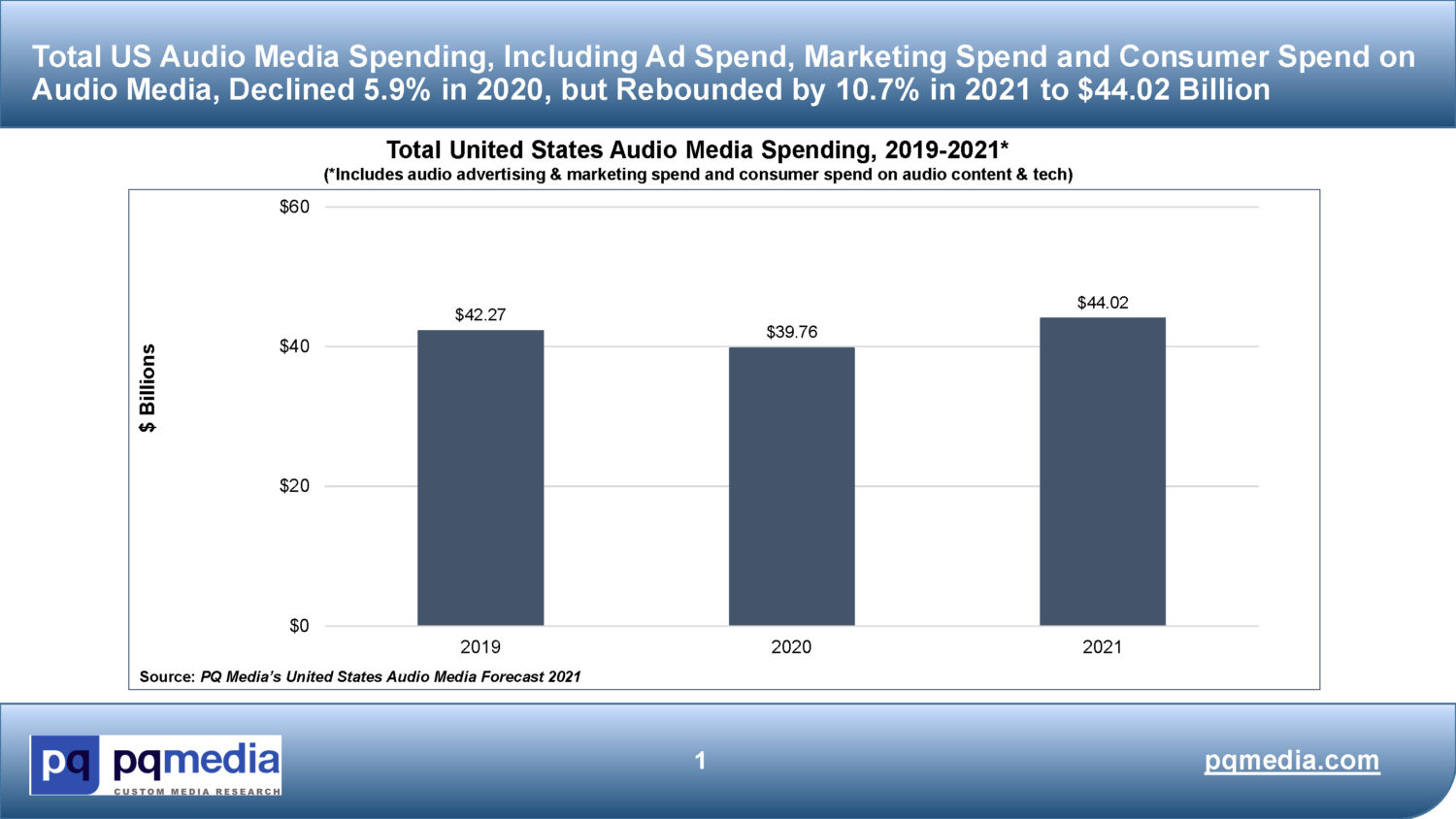

Audio Media – Part 1: Definitions & Segmentation The third edition of this newsletter focuses on another of the most dynamic and fast-growing segments of the media industry in recent years, particularly during and following the apex of the COVID-19 pandemic – Audio Media. PQ Media in November 2021 published the first United States Audio…

PQ MEDIA INTELLICAST (Issue #2, November 2021)

—

by

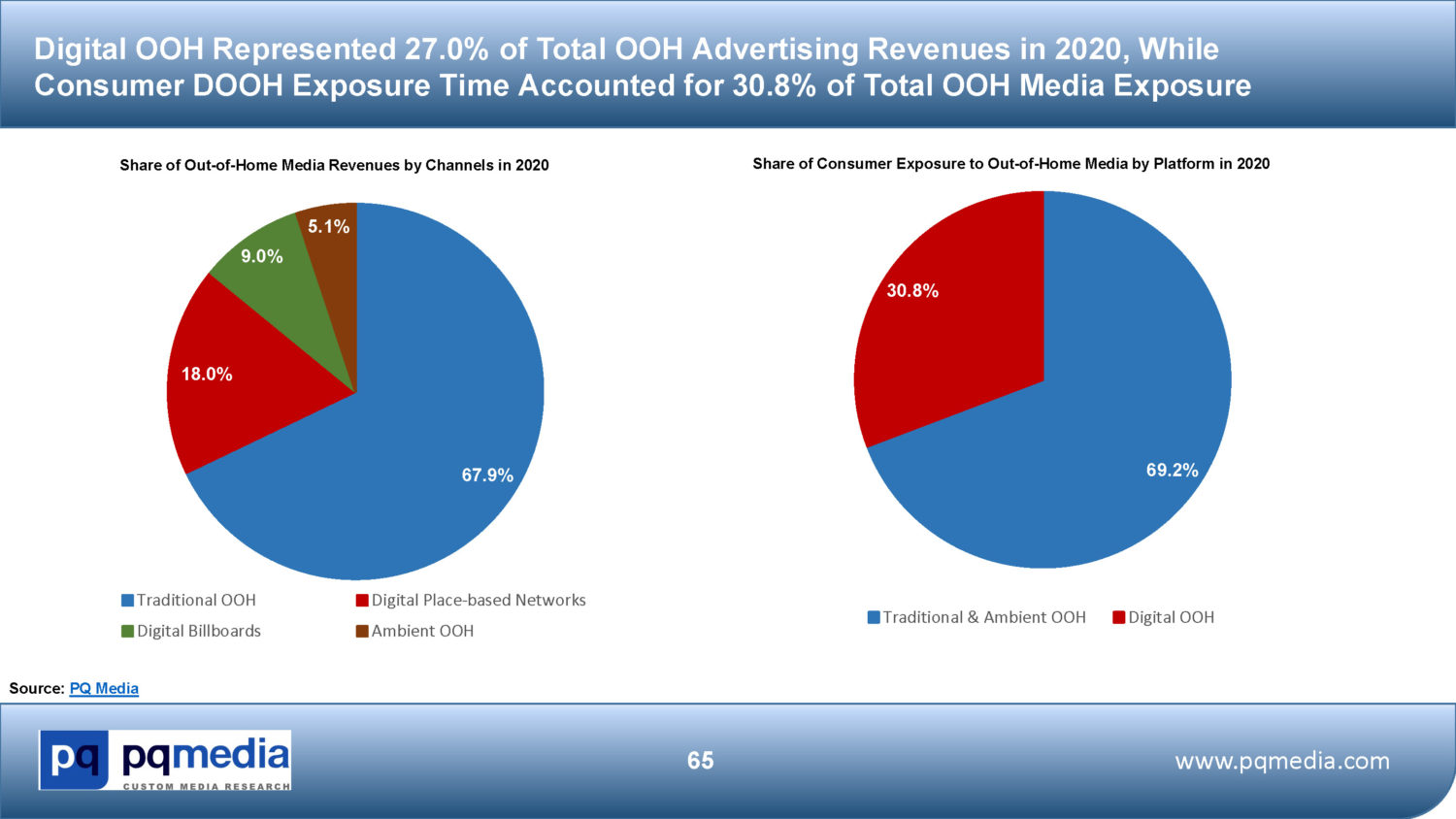

Digital Out-of-Home Media – Part 1: Definitions & Segmentation This second edition of this newsletter focuses on one of the most dynamic and fast-growing segments of the media industry over the past decade – Digital Out-of-Home (DOOH) Media – for which PQ Media was the first market researcher to define, segment, size, analyze and project…

PQ MEDIA INTELLICAST (Issue #1, October 2021)

—

by

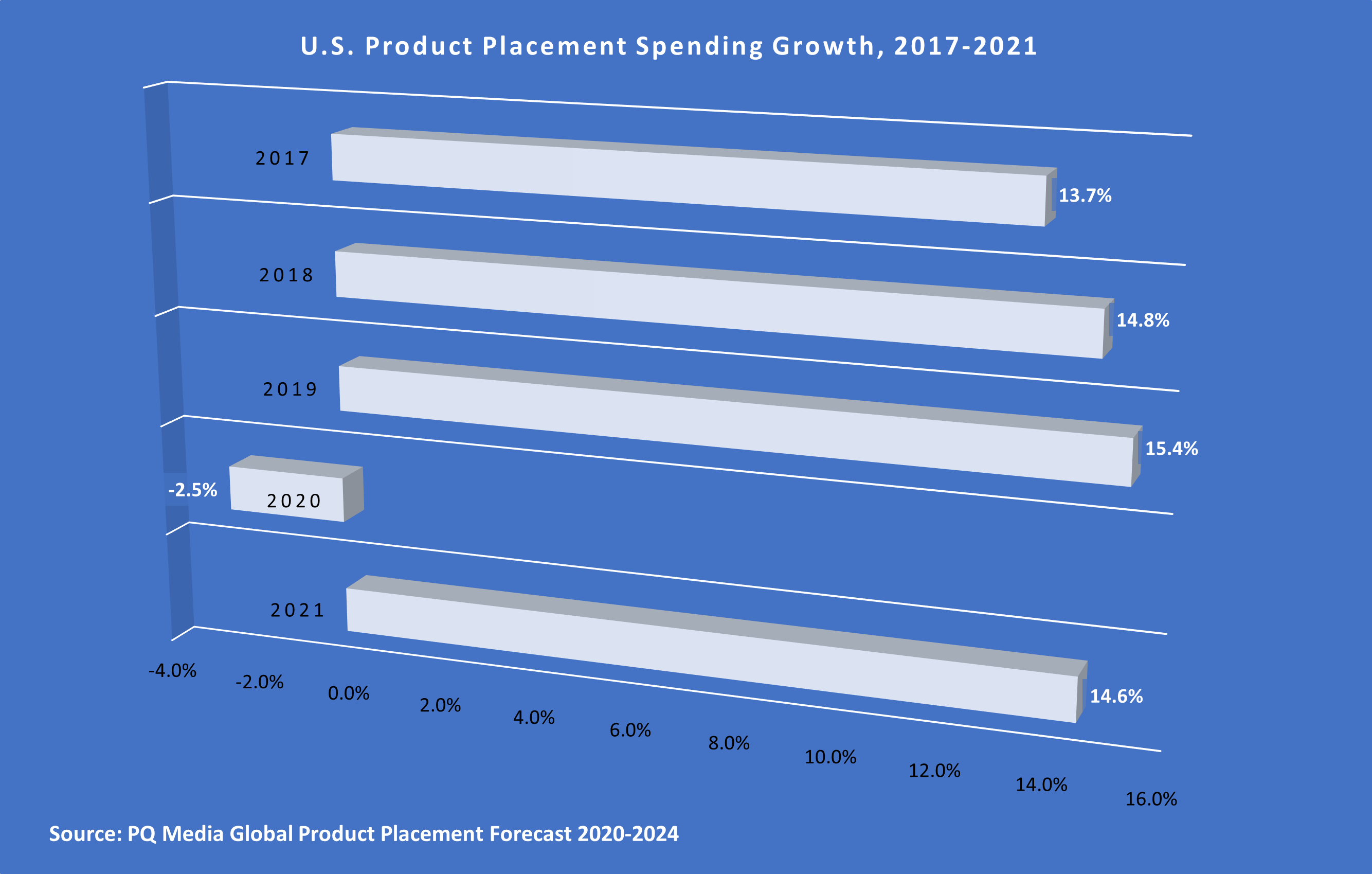

PQ MEDIA INTELLICAST (Issue #1, October 2021): Focus on Branded Entertainment (Product Placement & Experiential Marketing) – In this first edition, we will examine one of the most consistently fast-growing and constantly evolving alternative marketing segments of the media industry over the past two decades – Branded Entertainment Marketing – which PQ Media was the first market researcher…