Your cart is currently empty!

INTRODUCTION

Dear PQ Media Friends,

Welcome to your FREE issue of the new PQ Media Intellicast newsletter! PQ Media has launched this newsletter to focus on fulfilling a number of outstanding market intelligence needs expressed to us through a survey performed earlier this year of our current, past and new clients who have purchased either our annual market intelligence publications or our custom drill-down research services.

As a member of one of these client verticals, you have been selected to receive each of the first four issues of this newsletter on a monthly basis in October, November, December and through the final FREE issue to be distributed in January 2022.

Our objectives in providing these four monthly issues to you at no cost are to share more of our data and content with you to help educate you on the diverse set of media industry sectors, segments, platforms and channels we cover, which we hope will inform some of your decision-making and give you a better understanding of the breadth and depth of our media and technology industry research coverage.

We encourage you and your colleagues to sign up for this Free Trial via the sign-up form that appears on our website after you click the following link: PQ Media Newsletter Signup. We also encourage you to share your critical feedback – in strict confidence – about the content and usefulness of this new research-driven newsletter by emailing us at info@pqmedia.com.

Following publication of the fourth issue in January 2022, we will be relaunching this newsletter through a cost-effective subscription format, which will be driven by your critical feedback on the value of the data and analysis we’re providing through this free trial period.

Each of the four editions you will receive through January will focus on one of several of the most dynamic and fast-growing segments of the media industry over the past decade, including Branded Enteratinment, Digital Out-of-Home Media, Audio Media, and PQ Media’s holistic perspective on the Global Advertising & Marketing Industry.

I hope your free trial to the new research-driven PQ Media Intellicast will help you grow your business in the coming months, and I look forward to receiving your valuable feedback.

Best regards,

Patrick Quinn

CEO & Publisher

PQ Media LLC

PQ Media Intellicast

PQ MEDIA INTELLICAST (Issue #3, December 2021)

Audio Media – Part 1: Definitions & Segmentation

The third edition of this newsletter focuses on another of the most dynamic and fast-growing segments of the media industry in recent years, particularly during and following the apex of the COVID-19 pandemic – Audio Media. PQ Media in November 2021 published the first United States Audio Media Forecast 2021, the most comprehensive, in-depth and actionable source of econometric data and analysis ever compiled on the entire audio media industry.

Covering the 2019-2023 period and examining all three industry KPIs – audio advertising & marketing spending, consumer audio listening time, and consumer spending on audio content and technology – the new Forecast provides strategic insights, data and growth projections for more than 40 audio media platforms, channels and categories. The US Audio Media Forecast also includes exclusive data and confidential insights provided by leading audio media companies; radio station and network groups; digital streaming audio services; podcast producers; audio advertising agencies; and media investment firms.

Audio Advertising & Marketing – Definitions & Segmentation

Audio Advertising Media: Brand messages on audio media that often have entertainment and/or information content, and which are often audited to determine the revenues of the operators within the media platform, as well measured for the size of the overall audience and specific to the target audience.

Audio Marketing Media: Brand messages that are often positioned near the point of decision, aim to improve client or customer relations, or appear at locations that offer one-on- one interaction opportunities, in which operators are often not audited for revenues, nor any target audience measurement is available for the entire platform.

Over-the-Air (OTA): Also known as broadcast radio or terrestrial radio advertising, are ads developed and distributed by radio networks and stations over the airwaves and listened to through various conventional receivers, including multi-functional stereo receivers, car stereos, clock radios, and mobile devices, among others.

Digital Audio: Includes ad messaging that runs via internet and mobile devices that includes streaming audio, banner ads, sponsorships, texting, and mobile marketing apps that help to drive engagement. It includes ads found on the digital extensions of radio stations and networks, streaming services that include radio-only subscriptions and those that combine access to digital radio programming and recorded music playlists, as well as podcast advertising.

Satellite Radio: Ads run on select satellite radio networks of SiriusXM.

Experiential Marketing: Live events that allow brands to interact with consumers in one venue in order to build brand image and awareness. For audio companies, experiential marketing includes:

- Event Sponsorships, which are live consumer events, such as concerts, that are mutually beneficial to a brand, audio media company and the concert promoter. The brand provides funding to support the planned event in exchange for marketing opportunities, including face-to-face interaction with audiences and virtual event opportunities through gaming platforms, such as Roblox and Fortnite;

- Event Marketing, which are live events managed exclusively by the audio media company for brands, such as remote broadcasts, to promote in-person engagement with target audiences through a variety of venues.

Promotional Marketing: Tactics used to generate sales at retail outlets, including digital extensions, and to help sell merchandise. Although there are seven different promotional categories, such as coupons and sampling, the only category related in audio media is brand licensing, which is revenue generated via permission granted by audio media operators to use their images on products that are sold to the public, such as t-shirts, with a station’s logo, disc jockeys or concerts being promoted. Stations also generate promotional revenue by developing e-commerce tabs via websites to help sell their sponsor’s licensed products.

Consumer Audio Media Usage – Definitions & Segmentation

Consumer Audio Usage: The average number of hours per week a consumer listens to digital or traditional media content, advertising or services for personal entertainment or informational purposes, or as a result of consumer brand advertising or marketing through various media platforms and channels.

PQ Media’s data and analysis included in this report is specific to the average total time an individual spends each week with audio, regardless of the location such as home, car or work. While audio consumption primarily occurs in the home or car, digital media devices have increasingly allowed consumers to access content in many other indoor and outdoor locations. To be consistent and to accurately reflect audio usage against other digital and traditional media platforms and channels, several original techniques were used

(For more details on PQ Media’s proprietary methodology for tracking audio media usage, download the free executive summary of the full report by clicking this link: United States Audio Media Forecast 2021).

OTA: Also known as broadcast or terrestrial radio, includes listening to radio station and network programming sent via radio towers in which consumers access the content using broadcast radio devices, such as stereo receivers, HD car radios, and other mobile or portable radio devices.

Streaming Audio: Content developed for listening on digital devices that include the digital extensions of radio stations, networks and satellite radio; listening to radio stations and networks on recorded music streaming services; and original podcast content developed specifically for digital audio listening.

Satellite Radio: Radio programming primary consumed in automobiles using specific digital equipment and is available only in two countries, the United States and Canada.

(PQ Media further breaks down audio media usage by distribution method, by modulation, and by location. For more details on PQ Media’s audio listening methodology and breakdowns, download the free executive summary of the full report by clicking this link: United States Audio Media Forecast 2021)

Consumer Spending on Audio – Segmentation & Definitions

Consumer Spending on Audio Content: Specific to paying subscription fees for services that offer audio content.

Consumer Spending on Audio Technology: Spending on devices to access audio, although the devices may be used for other purposes, such as accessing video and games.

Satellite Radio: Fees paid to SiriusXM to access that allow automobile owners to access satellite radio content in cars, in homes and on digital devices.

Audio Subscription Services: Fees paid to services offering access to a specific number of digital music downloads in a specific time period, as well as access to digital radio stations and networks.

Radio-Only Audio Subscription Services: Fees paid to services offering ad-free access to digital radio stations and networks.

Podcast Subscription Services: To avoid double-counting, specific to individual podcasts that require a fee to access the content. It does not include fees to streaming services that have podcasts, such as Spotify, which is already included in the Audio Subscription Services category.

Dedicated Audio Technology: Specific to technology with a sole purpose of accessing audio only.

Home & OEM Car Audio Receivers & Speakers: Purchase of various devices that can be used to listen to physical music formats and OTA, including stereo receivers, turntables, CD players, iPods, and OEM in-car radio receivers installed after purchase of the car.

Digital Audio Receivers (DAR) & Smart Speakers: Wireless devices that are purchased to listen to music, talk, or respond to commands. DAR is an in-home receiver used to directly access digital audio services, such as digital audio broadcaster (DAB), subscription services and/or online radio stations. Smart speakers are voice activated via questions or commands.

Audio Media – Part 2: United States Audio Market Analysis

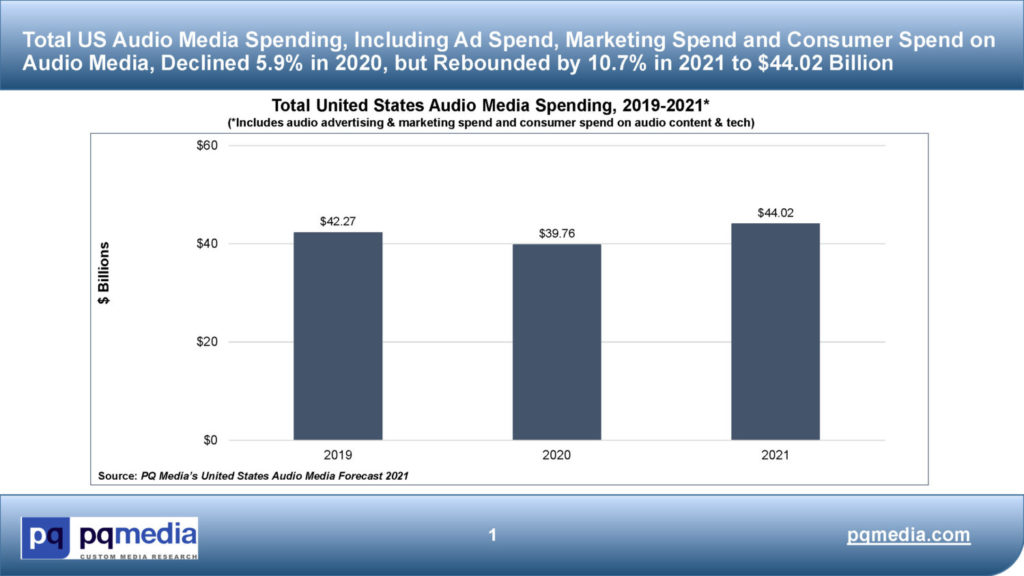

United States audio media advertising & marketing spending, as well as consumer audio usage and consumer spending on audio media are all expected to post record growth in 2021, amplified by new technologies, changing consumer behaviors and shifting ad budgets, according to PQ Media’s United States Audio Media Forecast 2021.

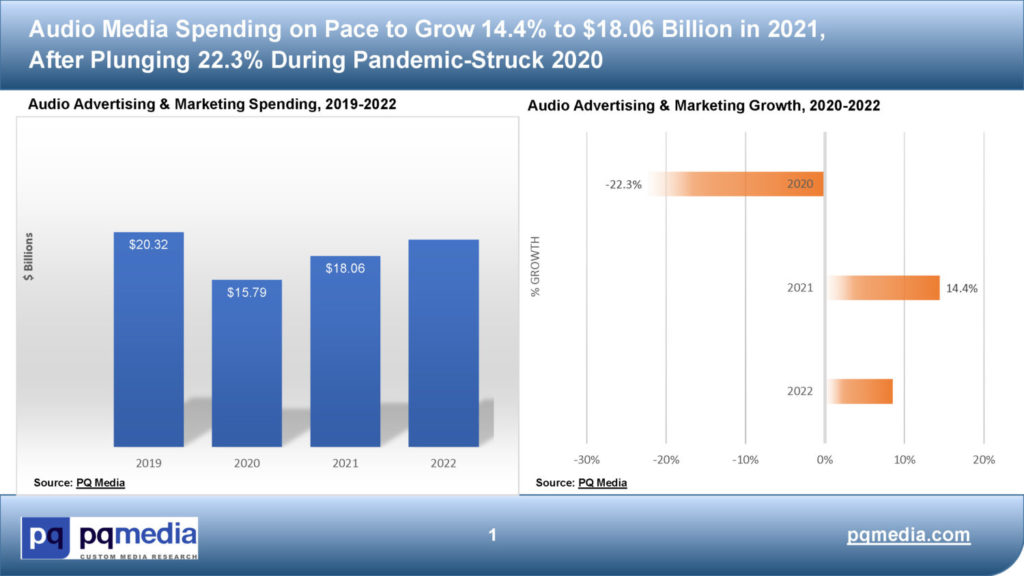

Audio ad & marketing spending is projected to grow 14.4% in 2021 to $18.06 billion, the fastest growth rate in 40 years, driven by double-digit increases in OTA, streaming, podcast, satellite and Hispanic audio ad & marketing spending, PQ Media estimates. Podcast advertising surged 32% in 2021, while Hispanic audio ad spend is set to rise 16.5%, OTA advertising is projected to increase 14.2%, and streaming audio ad spend is forecast to grow 13.4%.

The caveat to this year’s double-digit growth spikes in audio ad & marketing spending is that they follow the steepest drops on record in 2020, when all media spending was driven down by the deep impact of COVID-19 and the pandemic’s after-effects worldwide. For example, total audio ad spend, of which OTA accounts for 70%, is not expected to reach the pre-pandemic 2019 level until 2023, according to PQ Media.

However, streaming audio advertising, including digital extensions of radio stations and audio subscription services, and podcast ad spend continued to grow at double-digit rates during the pandemic’s apex in 2020 and will post accelerating growth in 2021 to set new ad spend records.

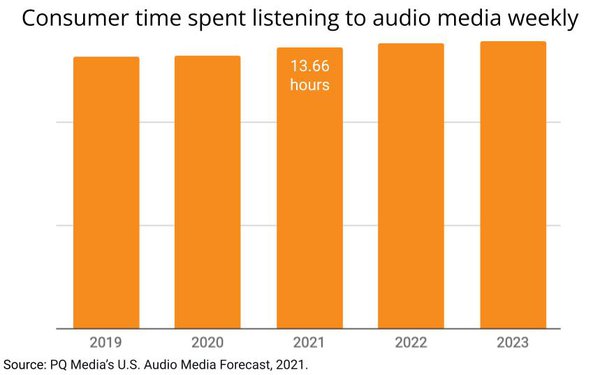

Meanwhile, consumer audio usage is expected to rise 3.3% to an average of 13.7 hours per week in 2021, the quickest uptick in 20 years, fueled by strong growth across all major audio platforms. OTA audio usage was up 2.7%, streaming media usage, including digital radio station extensions and audio subscription services, also increased 2.7%, while podcast listening surged 9.9% and satellite radio was up 2.5%, per the United States Audio Media Forecast 2021.

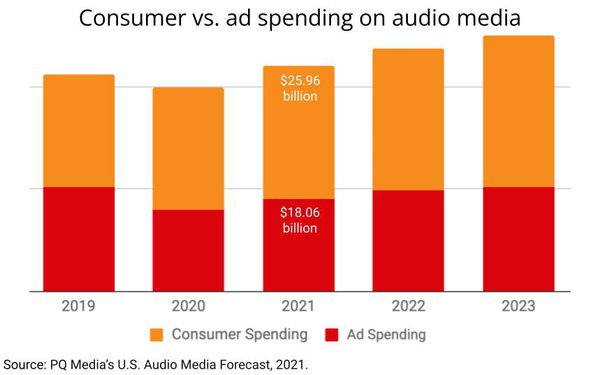

Consumer spending on audio media content and technology is expected to increase 8.3% to $25.96 billion in 2021, as end-user spend on audio content and tech also continued to grow through pandemic-struck 2020 and will continue to grow through 2022. The key growth driver is consumer spending on audio content, including streaming and satellite subscription services, podcasts and digital radio extensions, which has surpassed total audio ad & marketing expenditures, surging 12.4% in 2020, as the pandemic lockdowns supercharged consumer time spent with digital audio. Consumer spending on audio content will grow at an accelerated 12.6% to $19.62 billion in 2021, PQ Media estimates.

Audio has proven to be a resilient medium since its rise to the fore of the media spectrum in the 1920s, continually adapting to strong challenges posed by the emergence of new technologies, such as television in the 1950s, as well as related changes in consumer behaviors and shifting ad budgets. All three of these critical PEST trends were strongly influenced by COVID-19, but as these key variables evolved with the severe impact of the pandemic in 2020, audio media once again rose to the challenge and showed its staying power with consumers.

With the continued growth in the popularity of podcasting in 2021 and the increased use of smart technology to listen to digital radio station extensions, traditional OTA broadcasts have remained the most popular audio content consumers listen to in their cars. When audio media’s three major platforms are combined – OTA, digital and podcasting – audio is a powerhouse medium like no other.

Other key trends revealed in PQ Media’s US Audio Media Forecast 2021 include the following:

- AM/FM will remain the primary way consumers access audio through 2023, far outweighing consumer time spent with Spotify and Pandora;

- Content is king, as listenership will rise in audio segments that provide new, more engaging content, such as multicultural-focused programming on AM/FM stations, the emergence of new podcasting genres and riveting Q&A interviews on social media audio;

- Podcasting has become the sexiest audio media channel, enticing more brands to audio that, previously, had not included this medium in their omnichannel advertising and marketing campaigns;

- Hispanic audio – both digital and traditional – has emerged as a major force in the overall audio media industry, as Hispanic OTA advertising is pacing up 16.6% in 2021, while Hispanic streaming audio ad spend is expected to grow 14.8% this year, and Hispanic podcast advertising is projected to surge 38.5%.

Audio Ad Spend Outpaces Growth in Consumer Audio Spend, While Time Spent with Audio Continues to Expand

With podcast ad spending projected to surge 32% this year, advertising/marketing will be the fastest growing source of audio media revenue this year, outpacing the increase in direct consumer spending by a wide margin – 14.4% vs. 8.3%, according to the US Audio Media Forecast 2021.

The report, however, also found that direct consumer spending on audio subscription services continues to be the dominant share of the marketplace, accounting for 59% of the $44.02 billion the US audio media industry – both conventional radio, as well as digital audio services – will take in this year.

The good news for the overall medium, regardless of revenue stream, is that consumer consumption of audio continues to rise as new platforms and formats expand. PQ Media estimates the average American consumer will boost their time spent listening to audio media this year by 3.3%, rising to an average of 13.7 hours weekly.

Contrary to data released by other market researchers in recent years that overall digital media is the most used media platform, most of digital media usage, other than social media and search, occurs via traditional media digital extensions, such as audio podcasts.

With many COVID-19 protocols relaxed in 1H 2021, overall audio usage exceeded 2019 levels, with OTA almost equal to pre-pandemic listenership, and streaming audio and podcast listening soaring. PQ Media’s research has long indicated that consumers engage more with audio content than with most other media, and the surge in podcast listening is taking this trend to an even higher level.

Audio Media – Part 3: Key Audio Market Growth Drivers & Challenges in 2022-2023

- Based on PQ Media’s analysis of the major trends driving the audio media business, we believe the audio industry has been proactive in evolving to meet the challenges brought on by the pandemic, new technology and changing consumer behaviors;

- There are numerous opportunities for the industry to pursue, such as targeting specific brands and industries for investment and continuing to expand podcast programming to drive more audio listenership;

- Conversely, there are numerous challenges, foremost being the education of major brands and agencies about the benefits of audio, as well as deciding what to do as an industry about programmatic media buying;

- Audio media operators need to accentuate the positive about their products and services, such as touting that audio is the second most used medium behind only broadcast television and other digital video services;

- Audio operators enjoyed double- and triple-digit gains in 2Q 2021 across most of their offerings, but that growth began to decelerate in 3Q 2021;

- OTA advertising is under pressure from ad agencies that believe a higher number of people are working from home and younger audiences are listening exclusively to streaming audio subscription services;

- Digital extensions of OTA stations and networks are primed to gain more ad dollars, as PQ Media’s research shows that digital audio listening is increasing;

- Podcast listening is surging as more brands experiment with this hot audio channel, but it is still a nascent channel in which a $7 million ad buy can double growth, compared to the same OTA buy generating a mere 1% increase;

- Biggest quandary for audio operators is programmatic media buying, where share of audio ad spend bought via programmatic systems is among the lowest in the overall media industry.

Audio Media – Part 4: US Hispanic Audio Market Analysis, 2020-2023

- Growth in US Hispanic social, economic and media clout is reflected in Hispanic population growth and increased share of total US population, which grew to 62M (19%) in 2020 from 51M (16%) in 2010 – for 22% growth over the past decade;

- During the same 2010-2020 period, the number of radio stations programming Hispanic-focused content (Spanish & English) grew 20% to approximately 1,200 stations nationwide in 2020;

- But while Hispanic consumers account for 19% of the overall US population, Hispanic media investments draw only 4% of total US advertising & marketing spending;

- US Hispanics also over-index in radio listenership versus overall US audio market, which is attractive to advertisers, but brands have yet to increase their budgets accordingly, except for individual campaigns like those in states with contentious races during the 2020 election cycle;

Key Hispanic Audio Challenges Going Forward

Hispanic media is harder to buy programmatically for two main reasons:

- Many Hispanic-owned companies don’t collect vital demographic information needed for DSP systems to highlight;

- Some data in programmatic systems derived from credit cards, but Hispanics less likely to use cards than average American

Full Market Outlook & Free Report Downloads

PQ Media’s United States Audio Media Forecast 2021 is the first, most comprehensive, in-depth and actionable source of econometric data and analysis covering the entire audio media industry for the 2019-2023 period by all three industry KPIs – audio advertising & marketing revenues, consumer audio usage, and consumer spending on audio content and technology – covering over 40 digital and traditional audio media platforms, channels and categories.

Site licenses to the new Forecast include two deliverables – a PDF Report in PowerPoint format delivering 553 slides of data, analysis and datagraphs; and a Deep-Dive Excel Databook providing hundreds of drill-down datasets and datapoints. To download a FREE Executive Summary and Sample Datasets from the new report click: United States Audio Media Forecast 2021.